A timeline of India’s Cash Ban: A man-made currency crisis one year later

On 8th November 2016, India's Prime Minister Narendra Modi announced that the 500 and 1,000-rupee notes would be replaced with new 500 and 2,000-rupee notes in a radical attempt to crack down on 'black money, fake currency menace, terror funding and corruption'. Sadly, the population suffered severely while the goals were not met.

The two highest-denomination banknotes (once worth approximately US$7.50 and US$15.00 respectively) make up over 85% of all the Indian currency in circulation. Even though the impact was felt across sub-continent, it appears that it was the criminals who benefited as 99% of the banknotes were returned, foiling plans to hinder criminals from laundering their hoarded cash.

As a result of the sudden announcement, people raced to banks every day, queueing for hours on end in hopes that the bank wouldn't run out of cash before they can exchange as much of their old banknotes as possible. The government revised the many restrictions and limitations every few days in response to protests and petitions.

Excerpt from New York Times article two months after Modi's demonetisation announcement

...the economy is suffering. The manufacturing sector is contracting; real estate and car sales are down; and farm workers, shopkeepers and other Indians report that a shortage of cash has made life increasingly difficult...

This was meant to help identify people who were hoarding cash — or “black money,” as it is known in India — to avoid paying taxes or to engage in corruption. Mr. Modi’s government later said that it was also eager for Indians to move to electronic transactions...

But the swap was atrociously planned and executed. Indians had to line up for hours outside banks to deposit and withdraw cash. New notes have been in short supply because the government did not print enough of them in advance. The cash crunch has been worst in small towns and rural areas. The amount of cash in circulation fell by nearly half, from 17.7 trillion rupees ($260 billion) on Nov. 4 to 9.2 trillion ($135 billion) on Dec. 23, according to the Reserve Bank of India...Continue reading.

A timeline of India's man-made currency crisis

8th November 2016

Prime Minister Modi announces (with four hours notice) the demonetisation of the 500 and 1,000-rupee notes, giving people less than four days to exchange their notes at banks. Despite attempts to spin the radical decision as a 'miracle' for positive change, critics including Modi's key aide were quick to see through the political guise and object to the unfair execution and inevitable consequences.

9th November 2016

Reserve Bank of India Press Release: All scheduled and non-scheduled banks, including public, private, foreign, cooperative, regional rural and local area banks, remain closed for public on Wednesday, November 9, 2016.

10th November 2016

Hindustan Times: Banks stay open an extra two hours.

People can start exchanging their money at banks between but have until 30th December 2016.

11th November 2016

Hindustan Times: Banks stay open an extra two hours.

BBC: Airports, railway stations and hospitals stop accepting old 500 and 1,000-rupee notes... Government guidelines say it is possible to exchange 4,000 rupees - but it is not clear if this is per day or in total. If there is a legitimate explanation for the cash, the authorities say, it will be possible to exchange it.... Continue reading.

Catch up: Modi's plan failed in its two big objectives

"The Modi Government has created two records in the world. One, it made people stand in queues and many people lost their lives; Second, though Modi tried to tell the people and the world that by demonetisation he would stop black money, in reality he has helped hoarders change black money into white," - Brinda Karat, Leader of CPI(M)

SCMP: “Recalibration of ATMs will be completed within two weeks,” Finance Minister Arun Jaitley said on Friday. Meanwhile, reports of sporadic incidents of violence are trickling in from across the country as patience is running out for customers waiting for hours in serpentine queues outside banks and ATMs.

“First, there was loss of work which had kept him worried and then the added pressure of standing in bank queues... My husband’s death meant that I was pushed to the brink. Had it not been for my landlord agreeing to let me live rent-free, I would be homeless...”

14th November 2016

First Post: Government extended acceptance of Rs 500 and Rs 1,000 notes for public utility and fuel payment till 24 November

16th November 2016

First Post: Chaos continues at banks; most ATMs ran out of cash

17th November 2016

First Post: Government lowers the exchange limit for now-defunct 500 and 1,000 rupee notes to Rs 2,000 from the existing cap of Rs 4,500

18th November 2016

NDTV: Chief Justice of India TS Thakur said petitions challenging the ban on Rs. 500 and Rs. 1,000 notes indicate the magnitude of the problem. "You have scrapped 500 and 1,000, but what happened to the 100 rupee note?" the Chief Justice asked the government, referring to the daily scramble for cash across the country and the punishing queues outside banks and ATMs.

19th November 2016

First Post: Queues got shorter at banks; long wait at ATMs continued.

21st November 2016

Finance ministry statement: Satish Kumar, a vegetable merchant in Delhi’s Uttam Nagar, died standing in a bank queue while trying to exchange his life savings of Rs 48,000 in demonetised currency notes. Doctors later attributed his death to a heart attack.

24th November 2016

Hindustan Times: The Centre on Thursday extended the usage of old notes for payment of public utility bill till December 15, but ended the deadline for over the counter exchange of the banned Rs 500 and Rs 1000 notes.

“It has further been felt that people may be encouraged and facilitated to deposit their old Rs 500 and Rs 1,000 notes in their bank account... Consequently, there will be no over-the-counter exchange of old Rs 500 and Rs 1,000 notes after midnight of 24.11.2016"... Watch on Times Now

15th December 2016

Indian Express: Last day to pay public utilities with old banknotes.

15th December 2016

Indian Express: Then Chief Justice of India TS Thakur questioned that why people were unable to receive the rationed amount of cash per week when some people were getting lakhs in the new currency. Attorney General Rohatgi’s comments in the apex courts had raised the issue that some bank managers were involved in illegal activities. The Supreme Court had also sought answers from the Modi government on whether demonetisation was constitutional.

16th December 2016

The Hindustan Times: Seventy-eight-year-old Nand Lal breaking down outside a State Bank of India branch in Gurgaon has become the face of the country’s hardship following the government’s demonetisation move.

30th December 2016

The last day people are allowed to exchange their old 500 and 1,000-rupee notes at banks.

"This hardship is only for 50 days [...] Please, 50 days, just give me 50 days. After 30 December, I promise to show you the India that you have always wished for."

1st January 2017

Indian Express: Income Tax department sends notices to around 18 lakh taxpayers to give explanations of large deposits made into accounts after demonetisation. Also, the Economic Survey 2016/17 says note ban reduced GDP growth by up to 0.5 per cent in ficsal year 2017.

27th February 2017

Indian Express: Strikes seen across the country. Banking operations brought to halt. Bank employees demand increased injection of cash as well as some relief in workload.

28th February 2017

Indian Express: The statistics department comes out with growth numbers. GDP growth rate found to have slowed to 7 percent during October-December 2016 quarter.

21st March 2017

Indian Express: The Supreme Court of India asked the Central government why it was unable to create a separate category for people who were unable to deposit their demonetised case before the December 30, 2016 deadline just like it had done for the NRIs and people not present in India at the time.

1st April 2017

Indian Express: The last day in which the exchange of demonetised currency was permitted.

Catch up: India's cash crisis six months later

The short-term effects of the overnight ban included 'an immediate slowdown of India's economy' as millions had to miss work to find a bank, many travelling hours if not days. Almost 40% of the population is unbanked so the ban did not push them towards electronic payments as Modi intended, instead, they regressed to 'trading surplus stock for other groceries'.

20th October 2017

Times of India: Opposition parties on Tuesday announced that they would observe November 8 as a 'Black Day,' as it was on this day that the government announced demonetisation last year.

8th November 2017

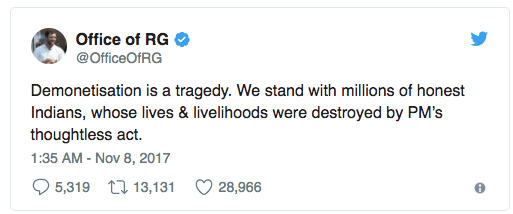

NDTV: On demonetisation anniversary today, Congress Vice President Rahul Gandhi will participate in a candle-light vigil in Gujarat's Surat as part of the opposition parties' "Black Day" protest. His visit is also significant as the state will go for assembly elections next month.

8 January 2018

New York Times: India’s reluctance to give up paper money poses challenges for the firms that are vying to offer electronic payments, including local players like Paytm, which has received financing from the Chinese e-commerce giant Alibaba, and American tech companies, like Facebook, Google and PayPal.