Cashless Business Shuts Out Australians Ineligible for Credit

Exclusion concerns have been raised in Australia following the announcement of a cashless trial at a coffee shop chain. Critics argue that cash—among other benefits—enables people ineligible for credit cards to pay for goods and services, and these individuals may be shut out of cashless businesses.

Chris Grice, Chief Executive of National Seniors Australia, said to Sky News that increasing numbers of businesses, including hotel and hire car chains, are going cashless and also refusing debit cards, making their services inaccessible to a wide cross section of society who want or need to use cash, or for whom credit is not an option.

To receive a credit card, people must meet certain criteria, and many individuals—whether due to low or unsteady incomes, being retired or other factors—are turned down. Even retirees who say they have income and assets well above the amount required for repayments have reported being denied access to credit cards for unclear reasons.

Grice adds that fees associated with cashless payments are also disadvantaging consumers, given most businesses are unwilling or unable to take the hit to their profits, obliging them to pass transaction costs on to customers.

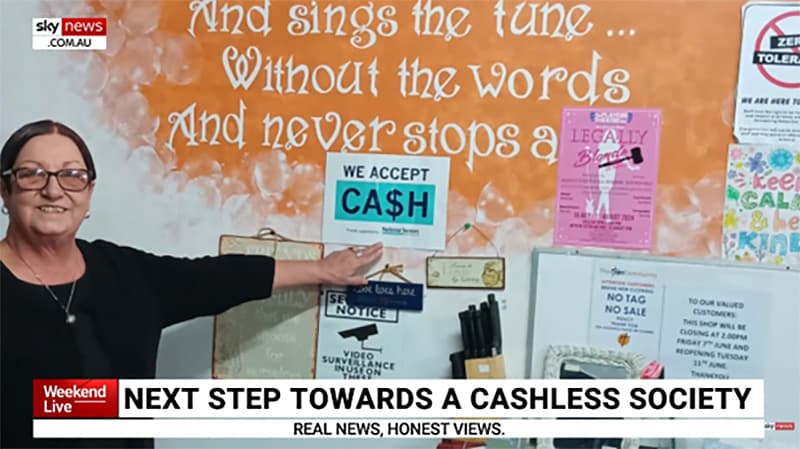

Grice says that while other organisations are calling for punitive measures to ensure businesses accept cash payments, National Seniors Australia has instead opted for a simple, clear sticker businesses can display saying WE ACCEPT CA$H. He says thousands of retailers across the country are already using them to signal inclusive and welcoming business practices.

Given the present economic struggles, Grice believes pro-cash practices could help facilitate more spending and believes cashless business is ‘a missed opportunity’. He adds that the cashless trial announced by Gloria Jeans coffee shop chain is disappointing, especially if they do not have a plan in place ‘to address [added] fees.’