"Cash use in Germany", a study on the extent of illicit payments (Deutsche Bundesbank, 2019)

The association between cash and crime is often brought up within payments debates, even though there is little-to-no evidence suggesting that restricting cash use would curb criminal activity. This new study agrees this lack of evidence is too often overlooked in its significance, and concludes that simply put, "it is not possible to paint a clear picture of the significance of illicit cash use in Germany" (p. 77).

This begs the question, will policy-makers think twice before promising to tackle crime by restricting cash at the expense of law-abiding citizens if they know that proving its success on criminal activity is near impossible?

"The study concludes that cash is, of course, also used in the shadow economy. But, the shadow economy is naturally underpinned by cashless payments, too. "

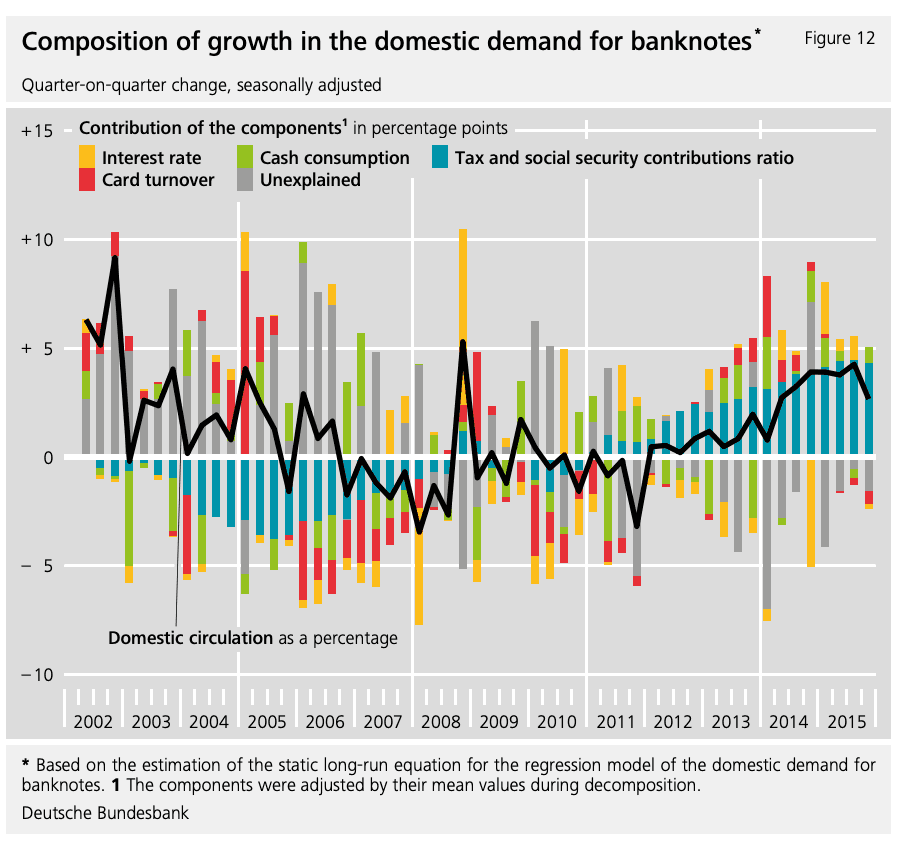

Authored by Nikolaus Bartzsch and Matthias Uhl from the Deutsche Bundesbank in a collaboration with shadow economy expert, Professor Friedrich Schneider of the Johannes Kepler University Linz, the study employs a time series econometric regression analysis to question why people hold cash in Germany, and whether there's enough evidence to presume it's in a criminal environment.

Bartzch, Uhl and Schneider respond to two trending ideas on the payments debate, including Kenneth Rogoff's arguments for eliminating the highest and lowest denominations and the "currency demand approach". The paper furthers existing observations on these trends, particularly on how they lack an understanding of legal cash demand as a store of value. Ultimately, the study argues that data concerning illicit cash use is overestimated.

Key findings include*

- In Germany, the estimated size of the shadow economy makes up 2.4%-16.6% of the country's GDP.

- In Germany, the estimated size of the shadow economy equates to €80-€550 billion.

- It is impossible to paint a clear picture of illicit cash use in Germany.

*The study acknowledges that there is a natural above-average degree of uncertainty when it comes to private cash use, therefore, findings must be interpreted as estimations.

These findings strengthen the topics explored in our first white paper: Keeping Cash: Assessing the Arguments about Cash and Crime, concluding that targeting cash simply misidentifies the issue at hand.

Although the study focuses on Germany, this key message might be agreed with globally: "direct references to the volume of banknote circulation or the circulation of large-denomination banknotes are not suitable for analyzing the demand for cash in the shadow economy."

The paper was published three months after the European Central Bank ceased issuing the largest denomination, the 500-euro banknote to curb criminal activity. Despite mentioning the ECB's cash restriction in Dr Johannes Beermann's forward, the study does not explore it in-depth as a case study, instead "leaving the question of their effectiveness open".