Australians Cite Privacy and Security as Top Reasons to Keep Cash

Just over a quarter of Australians would experience ‘major inconvenience’ or ‘genuine hardship’ if cash were to become difficult to access or use, with increasing numbers citing concerns around privacy and security as the number one reason they need physical money.

These insights come from the latest Consumer Payments Survey conducted by the Reserve Bank of Australia. This sixth triennial survey saw one thousand participants record their transaction details for one week and answer a questionnaire gauging their payment preference, cash holdings and perceptions of cash access.

Cash use for in-person transactions has declined, reaching 16 percent in 2022, with people most likely to pay with notes and coins in the services and retail sectors, and for leisure purposes or settling bills. Respondents aged 65 and above were most likely to be classified as high cash users, and lower household incomes are associated with more intensive cash usage.

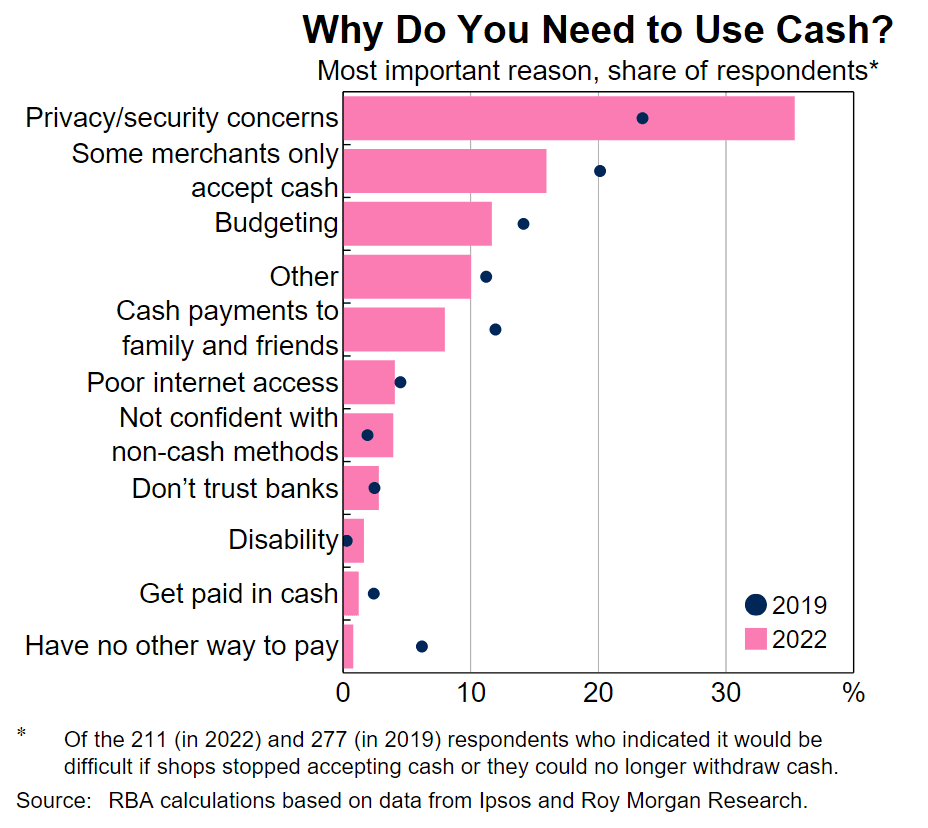

Regardless of how frequently they use cash, over 25 percent of respondents indicated losing it as a payment option would have a serious negative impact on them. When asked for the reasons behind this, by far the largest share—more than a third—cited privacy and security concerns as their principal reason. This is a marked increase since the previous survey, when less than a quarter of people had such concerns, ‘perhaps reflecting high-profile cyber incidents in the past few years.’ The next most common reason was that some merchants transact exclusively in cash, with budgeting coming in third place.

The survey also found ‘many consumers perceive cash to be important as a back-up payment method’, with emergency transactions (e.g., a natural disaster) one of the most frequent reasons given for holding cash. Gift giving was another popular reason, with the ‘unreliability of other payment systems’ also cited, along with privacy and anonymity.

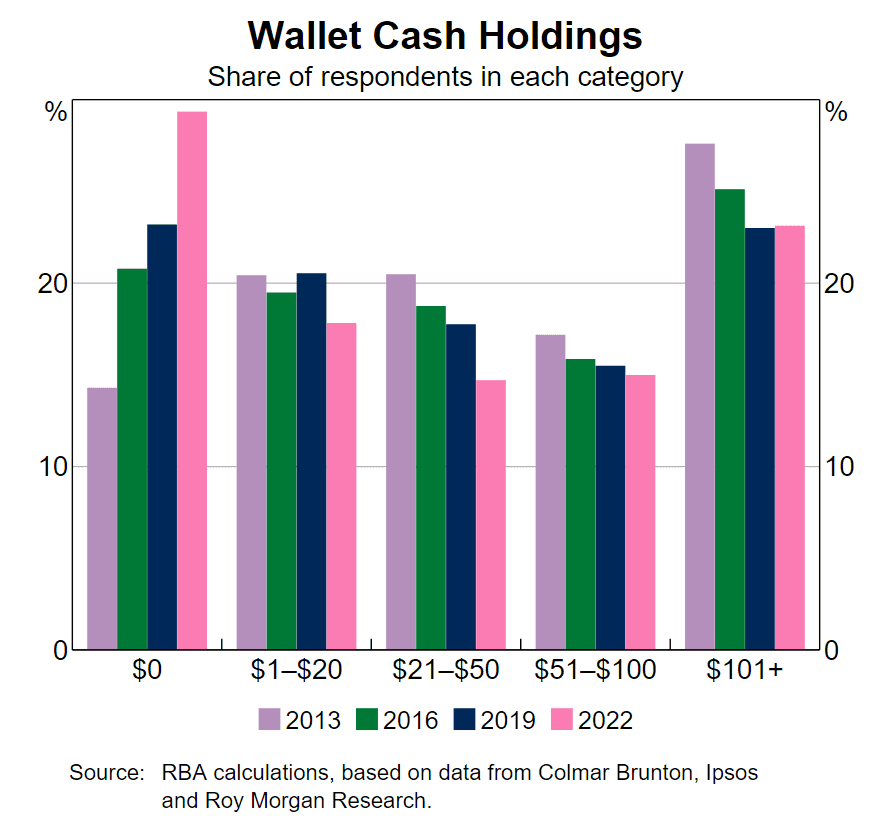

Most people continue to carry physical currency, though there has been a decrease since the previous study. The share of respondents who carry $100 or more remained steady, and higher denomination banknotes have gained popularity.

The study concludes that ‘despite declining cash use, its flow-on effects to cash access and acceptance have been modest to date’, though the Reserve Bank observes ‘there are vulnerabilities to cash access in some communities, particularly in non-metropolitan areas’, and restates its commitment to monitoring these trends.